So hello everyone welcome to all of you, today in this episode you will learn how you can plot the perfect support resistance by looking at the option chain actually you can also identify in which direction the market is going so sir everyone is ready excited to tell you the future path and we start so welcome all of you and today we are basically going to talk about which we talked about last time first of all let me tell you in brief that we talked about these six children reversal these six children reversal is basically the mind set of a trade which is our human cycle that we go there and get confused whether I have to exit the trade or enter so brother it is a simple thing when you enter at the last point then you should exit from here dailymom fansego yaar should stop so we will tell you directly that the specific point or points when the market will go below the support now let’s talk further we come back to the option chain in front of this image so let’s talk about the option chain again so basically we have here Nifty has an option change and we need this option of Nifty it is looking in the option chain of Nifty, now we are talking about support resistance, basically support and resistance, I have given my definition of support resistance, we are talking about support and resistance related to volume and open interest, we are going to see the chart with volume and open interest, no, most of the people who see the chart, see the price section, they basically see the formation of candles, how the candles are moving, I basically don’t go into the formation of candles, I rely on this data, see what happens, basically every n number of people in the market are trading with n number of triangles, but no matter how much is traded, all that data is coming collectively

So when we are looking at the wine in this option chain, it means most of the people thinking about wine in the market are those people

If we look at the sell side in this option chain So if we are looking at , it means most of the people are thinking about rain in the market by doing their own research, so we are researching their research

This is a simple thing, so let’s go here now, let’s see it basically, so first of all we will understand support and its definition

So what is the definition of support and resistance, let’s start with a hypothetical lifestyle price pair

Meaning on the hypothetical line, you have a pair of strike prices, hypothetical line, you will remember that we drew an imaginary line between 500 and 50050

This is awesome, this kind of pair is 500 and ₹ 550, we will start from its one in d price on the call side

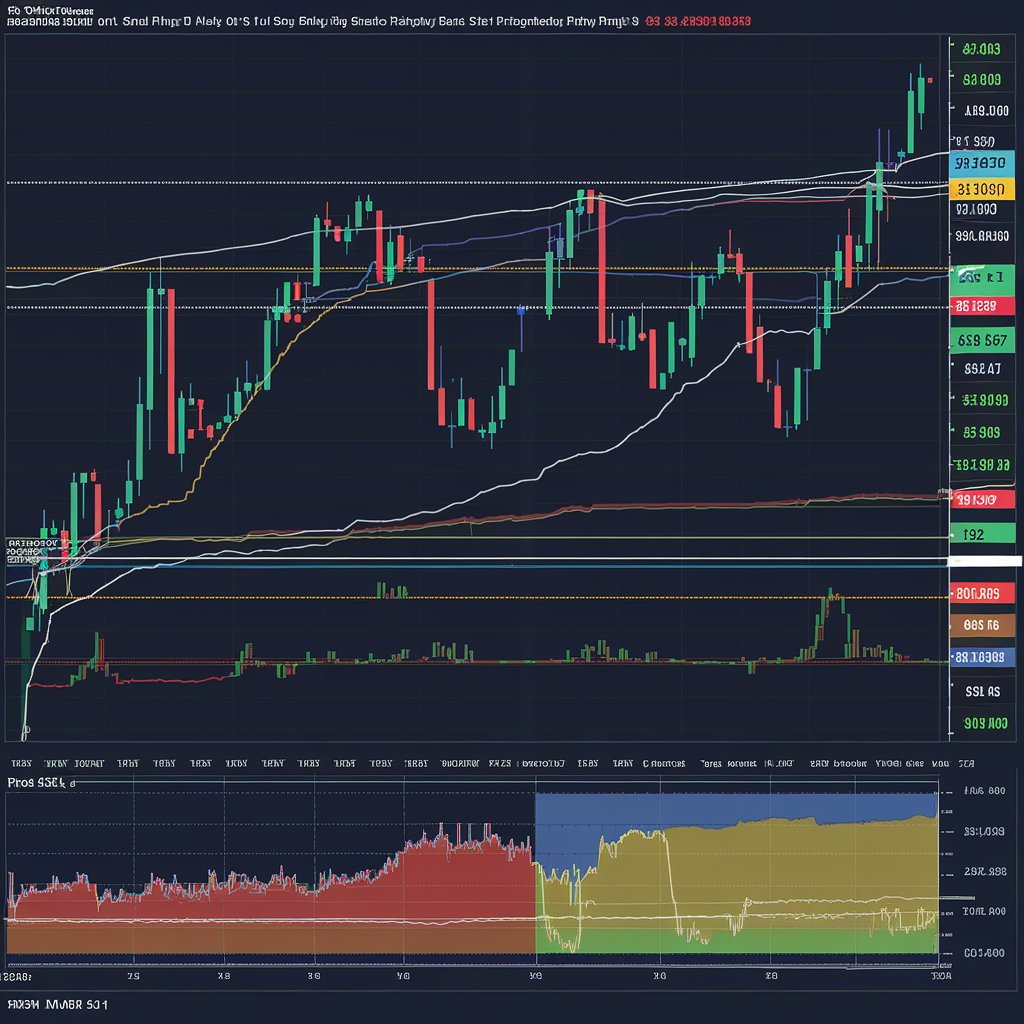

And from its one in d price on the put side, it means we will have resistance, right? It will be somewhere here, it will not be anywhere above, there will be no resistance anywhere here in the dark part. There will be an in-d gem from here. Why is there an in-d gem? Suppose sometimes the resistance is 500 then when the market comes above it to take an extension of 500 then 500 will automatically become an in-d gem. So this is what happens. We will start from 550 and from here we will move outwards from d. Where will we move on this side? Outwards from d. Now what will we get here? Largest open interest or largest volume. Whichever is closer to this imaginary line will be the resistance on the call side and support on the put side. Okay, now let’s see how this happens. Now see from here. Everyone knows the imaginary line. I will draw a small image inner line here. That’s all, sorry, okay. Now we have to find the largest open interest and we have found the largest volume. We can see this open interest at 18500, ₹ 135000. Now if you look at it a little more carefully, so if you look carefully here, basically I go a little down from here, from here we look a little more here, so look at this, we can see this, basically we can see the open interest of 150000. Here we can see ₹ 135000, so the biggest one is 6000, so this is our biggest open interest and if we talk about the biggest volume, you can see 32 lakhs and this is 23 5 10 6 2 nowhere, so this is the biggest volume, okay, so which of these two images is closer to us, this is ours, so the volume is closer in this, so the first thing we have to take care of is that we have resistance today of volume, okay, the difference you are making, the volume is the biggest ever. If there is a role then whose role is bigger, sometimes people ask me that sir tell me whether open interest is more important or volume, then I have only one answer that which is more important, break even or break even both are important, we will use it when needed, so which is going to be more important for us today, let’s talk about volume, on volume…